India’s second-hand car

market is booming. In 2024 alone, over 54 lakh used cars were sold—outpacing

new car sales, which stood at 4.1 million. Several factors are driving this

trend: the widening price gap between new and used vehicles, stricter emission norms

pushing up prices of new models, and the rise of organised platforms that make

the resale process easier and more transparent.

However, amid the

excitement of choosing the right model and finalising the paperwork, one

important step is often overlooked—transferring the insurance policy.

Why Insurance Transfer

Is Non-Negotiable

Under the Motor Vehicles

Act, it is mandatory that car ownership must be transferred to the new owner

within 14 days of purchase. While the Act doesn’t explicitly penalise delays in

updating the insurance, failing to transfer the policy can lead to own damage

(OD) claim rejections because of mismatched ownership. This leaves the new

owner financially vulnerable in the event of an accident.

“An untransferred

insurance policy puts both the buyer and seller at risk. When making a claim,

mismatched ownership details can effectively render the insurance void, as if

there were no coverage at all.” – Mallikarjun Mallannavar, Chief Claims

Officer at Royal Sundaram

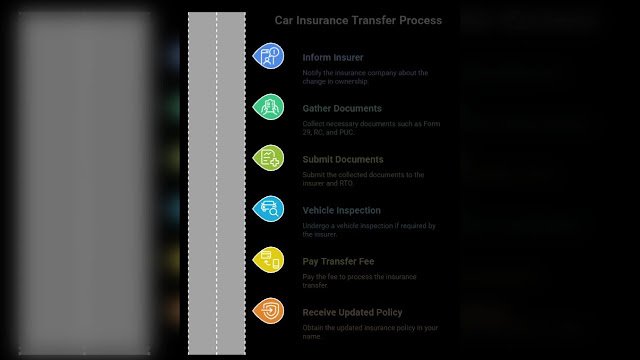

The Step-by-Step Transfer

Process

Transferring car

insurance is simpler than it sounds—and it’s one of the most important steps

after buying or selling a car. Here’s how you can do it:

Step 1: Inform the

insurer

Notify the insurance

company about the change in ownership as soon as the sale is complete.

Step 2: Gather the

required documents

You will need the

following documents:

- Form 29 and Form 30 (available from the RTO)

- Vehicle’s Registration Certificate (RC)

- Pollution Under Control (PUC) certificate

- Existing insurance policy documents

- No Objection Certificate (if the vehicle was financed)

Step 3: Submit the documents

Submit these documents to both the insurer and the

Regional Transport Office (RTO).

Step 4: Vehicle inspection

Depending on the insurer, a quick vehicle inspection

may be required.

Step 5: Pay the transfer fee

A small fee is charged to process the insurance

transfer.

Step 6: Receive the updated policy

Once approved, the insurer will issue an updated

policy in your name as the new policyholder.

What Happens If You

Skip It?

Apart from legal

penalties, you may find yourself without insurance cover in case of an

accident. Third-party claims, although mandatory, may be delayed if policy

details don’t match the ownership. The previous owner could also be dragged

into legal complications if the car causes damage or injury after the sale.

“Failing to transfer

the insurance can land the previous owner in legal trouble if the car is

involved in an accident,” says – Mallikarjun Mallannavar, Chief Claims

Officer at Royal Sundaram. “That’s why transferring the policy isn’t just a

formality—it’s a crucial legal safeguard.”

Final Thoughts

As more Indians opt for

pre-owned vehicles, understanding the legal and financial implications of car

insurance is crucial. Insurance transfer

is not just paperwork—it’s a vital step to ensure continued protection. Whether

you’re buying or selling, make sure the insurance is updated promptly to avoid

complications later.

.jpeg)